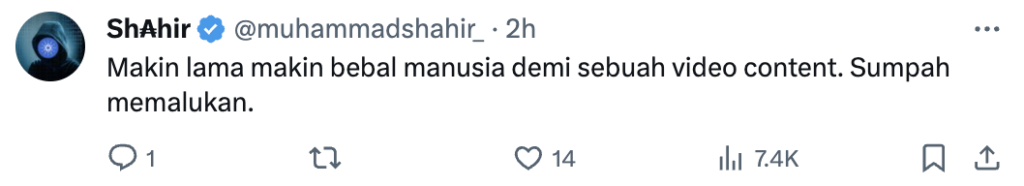

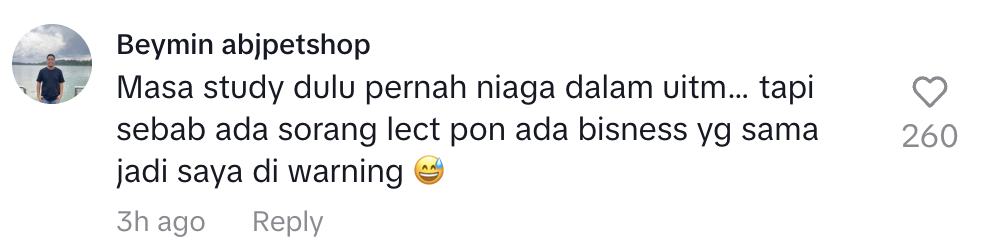

Safiey Ilias Jawab Isu Dakwaan Dirinya Buat Bisnes Cara Kotor|Sebelumnya seorang yang mengaku bekas leader perlaking,telah mendakwa safiey telah melakukan bisnes kotor dengan cara menipu leader leadernya.

Hinggalah isu itu menjadi perhatian ramai sehingga sampai ke telinga safiey sendiri.

Untuk pengetahuan umum nama leader tersebut adalah Ahmad Safwan,untuk mengetahui lebih lanjut berikut penjelasan safiey berkait isu ini.

1 lagi posting terakhir . Slepas ini tak nak dah posting untuk menjelaskan apa2 fitnah . Penat . Personal kena kecam , bisnes kena kecam , memang susah sgt2 jd org bisnes dan berhijrah ni . Saya diam tak bererti saya salah . Korg je suka mengadu kt FB ni , mengadu kt Allah lagi bagus dgn tadah tangan . Doa org teraniaya kan makbul (kalau kita dipihak yg benar lah) .

.

Nama leader itu adalahAhmad Safwan. Antara leader yg x perfome dan x restock 4-5 bulan . Leader x perfome 3bulan akan kene kick . Smua leader telah dimaklumkan .

.

Leader yg tak perfome akan diberi kelas marketin secara personal oleh rakan sayaZulhilmi Zaiki. Kelas tiap2 malam diadakan .

.

Bukan itu sahaja , seminar marketing 3 minggu sekali siap diadakan . Hampir tiap bulan ada seminar . Ada jugak bantuan group coaching di telegram dan whatsapp oleh saya sendiri .

.

Jgn salahkan HQ jika x dpt buat sales . Salahkan diri sendiri yg tak pandai guna peluang . Bila buat kelas tak nak datang . Kemudian salahkan HQ dan tebar fitnah bila tak perfome .

.

Mengenai harga pula , banyak harga berbeza sejak isu fake berleluasa . Pastikan beli PERLAKING yg ada hologram untuk lebih selamat . Saya tak kisah kalau org kata dia dropship lah , agen lah , kalau dia sendiri jual barang harga RM30 . Entah dia jadi agen siapa tak tahu .

.

Jangan kata ramai leader rugi . Ada yg siap beli kereta dan keluarkan produk sendiri lagi . Boleh belek album testimoni leader kami .

.

Dalam bisnes kdg2 ada jugak yg saya buat silap , kdg2 selalu buat keputusan ikut jenis otak seminit . Kemudan tarik balik . Maafkan saya atas sikap ini sebab saya sentiasa belajar perkara baru dalam bisnes .

.

Adik beradik saya sendiri mampu jual PERLAKING , saya sendiri masa raya pun jual perlaking dkt Felda Lakum kampung saya . Bisnes ni jangan harap pada orang , kita kena gerak sendiri . Orang dah bantu beri seminar PERCUMA , banner PERCUMA , flyers PERCUMA , kelas coaching PERCUMA pun tak nak guna lagi .

.

Kebanyakan org yg tak puas hati dengan saya dlm bisnes sebenarnya telah dimarah dan dimaki oleh saya sendiri . Saya mmg garang dalam bisnes . Boleh scroll status bisnes saya yg lama2 2013-2014 dan tengok cara saya menulis . Sebab tu saya cakap saya penat nk jadi baik biarlah saya kembali menjadi laser supaya korg tak fikir saya ni plastik atau ape .

.

Salah ke jadi laser ? Saya cuma jnis yg suka beterus terang . Tak perlulah nk kata itu ini mcm korg kenal saya dan pernah jumpa saya depan2 . Org yg pernah jumpa saya depan2 tak pernah ada masalah pun dgn saya . Ubahlah attitude sendiri rakyat Malaysia .

.

Percayalah pada konsep rezeki . Jgn join bisnes jika takut rugi .

.

Now saya akan slow2 undur diri daripada bisnes , biarlah saya bantu keluarga , adik beradik sendiri dan kawan2 untuk jadi pengasas pula .

The 6 secrets of cheap car insurance quotes

How to use car insurance firms’ own tricks against them to lower your car insurance premium and get a cheaper quote – 6 secrets revealed

Sometimes car insurance premiums make sense. People living in places with more car crime or who have more expensive cars pay more, for example. But they’re far from the only thing insurers up your premium for.

Insurers have gone as far as working out surgeons normally have more accidents where they were to blame than any other profession and building society clerks the fewest. They know Virgos were worst for accidents last year, but Pisceans had more convictions.

That means they will up your premium based on age, sex, job, post code and where you park park as well as what you drive.

But car insurance providers don’t have to have to have it all their own way weve found six ways to get cheaper car insurance that theyd really rather you didnt know.

1. Use the right job title

If you describe yourself as a chef when filling in your car insurance application your average quote is 98 higher than if you write kitchen staff comparison site GoCompare.com found and its not just cooks that have this problem.

Music teachers pay 86 more than teachers, office managers pay more than office administrators, and construction workers pay more than builders who in turn pay more than bricklayers.

Basically, if your job fits in more than one category, check car insurance quotes are for all of them before applying. For more on how your job affects your car insurance, check out GoCompares guide . And if youre a full time parent or retired make absolutely sure you check that box and not unemployed it could save you almost 300.

2. Add another more experienced driver to the policy

Its a crime to say someone who isnt the main driver of a car is, but adding a secondary driver is perfectly legal – and more than that, it can save you money.

Get their permission first, then add an experienced driver with a clean driving license and decent no-claims history to your insurance.

3. Never leave it till the last minute

Searching around and switching car insurance three weeks before your renewal date, rather than on the day, saves you an average of 280, comparison site Comparethemarket found with even bigger savings available for younger drivers.

Oh, and make absolutely sure you do compare and switch figures from Moneysupermarket.com show almost 6 million drivers just accept their auto-renewal quote costing them 113 a year.

4. Get some cash back

Comparison sites make money because when you switch products with them they get a referral fee from the insurer. But if youre clever, you can get that money yourself.

Topcashback is offering up to 110.25 cashback when you switch through them. Once youve compared prices and found which deal is cheapest, head over to one of them and see if you can get an even better deal by switching through the cashback site.

5. Pay up front

Did you know that many insurers charge interest on your payments if you spread the cost over the year? Well, they do. an average of 62 more Moneysupermarket worked out. So if at all possible, pay up front.

6. Cut your extras and boost your excess

GettyCar Insurance Car CrashGet cheaper car insurance without changing your car

Sometimes car insurance premiums make sense. People living in places with more car crime or who have more expensive cars pay more, for example. But they’re far from the only thing insurers up your premium for.

Insurers have gone as far as working out surgeons normally have more accidents where they were to blame than any other profession and building society clerks the fewest. They know Virgos were worst for accidents last year, but Pisceans had more convictions.

That means they will up your premium based on age, sex, job, post code and where you park park as well as what you drive.

But car insurance providers don’t have to have to have it all their own way weve found six ways to get cheaper car insurance that theyd really rather you didnt know.

1. Use the right job title

Phil Harris / Daily MirrorClemie Moody Masterchef

If you describe yourself as a chef when filling in your car insurance application your average quote is 98 higher than if you write kitchen staff comparison site GoCompare.com found and its not just cooks that have this problem.

Music teachers pay 86 more than teachers, office managers pay more than office administrators, and construction workers pay more than builders who in turn pay more than bricklayers.

Basically, if your job fits in more than one category, check car insurance quotes are for all of them before applying. For more on how your job affects your car insurance, check out GoCompares guide . And if youre a full time parent or retired make absolutely sure you check that box and not unemployed it could save you almost 300.

2. Add another more experienced driver to the policy

CatersA woman will have to grin and BEAR a fine – after attempting to use a giant TEDDY to beat traffic. The female driver, 19, placed a giant bear in the passenger seat of her car in the hope it would allow her to use a 2+ lane.Not all drivers get you a discount

Its a crime to say someone who isnt the main driver of a car is, but adding a secondary driver is perfectly legal – and more than that, it can save you money.

Get their permission first, then add an experienced driver with a clean driving license and decent no-claims history to your insurance.

3. Never leave it till the last minute

GettyClocks

Searching around and switching car insurance three weeks before your renewal date, rather than on the day, saves you an average of 280, comparison site Comparethemarket found with even bigger savings available for younger drivers.

Oh, and make absolutely sure you do compare and switch figures from Moneysupermarket.com show almost 6 million drivers just accept their auto-renewal quote costing them 113 a year.

4. Get some cash back

PAMoney

Comparison sites make money because when you switch products with them they get a referral fee from the insurer. But if youre clever, you can get that money yourself.

Topcashback is offering up to 110.25 cashback when you switch through them. Once youve compared prices and found which deal is cheapest, head over to one of them and see if you can get an even better deal by switching through the cashback site.

5. Pay up front

Butter StickSometimes spreading isn’t clever

Did you know that many insurers charge interest on your payments if you spread the cost over the year? Well, they do. an average of 62 more Moneysupermarket worked out. So if at all possible, pay up front.

6. Cut your extras and boost your excess

SWNSScrappage Scheme

Whats included in your car insurance quote? Breakdown cover? Windscreen cover? Theft from the car? Driving abroad? Personal accident cover? A courtesy car? Every extra adds to the premium. More than that, a lot of them might already be covered by things like your travel insurance, AA membership, home insurance or even your bank account.

Double check youre not double paying and then look to see if you really need these extras. Oh, and you need to check how much excess there is on your policy. This is how much you have to pay yourself when making a claim. The lower the excess the higher the car insurance, so work out how what you can afford to pay in the case of an accident and set your excess to that even 50 can make a difference.

And of course….

These will all lower your quote, but to pay less make sure you’ve compared car insurance providers too.

car insurance quotes,automobile insurance,auto insurance quote,discount auto insurance,car insurance online,car insurance online quote,cheapest car insurance,car insurance quote,insurance quotes,cheap car insurance,car cheapest insurance,car insurance,

Sumber: penhijaudaun

–> Klik jika rasa post ini patut dibuang

Artikel ini hanyalah perkongsian dari pelbagai website dan blog. Sekiranya perkongsian artikel yang dilaporkan disalahertikan kami tidak akan bertanggungjawab. Terima Kasih

0 comments:

Post a Comment